Tax Due Date Calendar 2024

Tax Due Date Calendar 2024 - Then direct deposit refund may be sent as. To avoid penalties and interest on unpaid taxes, taxpayers must ensure their federal income tax returns are filed by april 15, 2024. Web if the employer deferred paying the employer share of social security tax or the railroad retirement tax equivalent in 2020, 50% of the deferred amount of the employer share of social security tax was due by january 3, 2022, and. 13, 2023 — with the nation’s tax season rapidly approaching, the internal revenue service reminds taxpayers there are important steps they can take now to help “get ready” to file their 2023 federal tax return. For tax year 2022, the dates were: Web taxpayers have until tuesday, april 18, 2023, to file their 2022 tax return since april 15, 2023 falls on a federal holiday. Tax deadlines vary for startups and other businesses classified as corporations and limited liability companies (llcs). Web the new fafsa form will significantly improve, streamline, and redesign how students and their families use the form. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Web for calendar year 2024, the tax under § 4261(c)(1) on any amount paid (whether within or without the united states) for any international air transportation, if the transportation begins or ends in the united states, generally is $22.20. If day 15 falls on a saturday, sunday or legal holiday, the due date is delayed until the next. $5000 threshold for 2024 to phase in implementation. Keep your federal tax planning strategy on track with key irs filing dates. Traverse city, mi, us, november 27, 2023 / einpresswire.com. Generally, most individuals are calendar year filers. Web the new fafsa form will significantly improve, streamline, and redesign how students and their families use the form. Monthly deposits for payroll and income taxes are due on november 15 and december 15, 2023, but employers can use the remaining calendar year to get their information ready for the busy tax season in january 2024. Web forms filed quarterly. Important tax deadlines for the 2023 tax year. $5000 threshold for 2024 to phase in implementation. To avoid penalties and interest on unpaid taxes, taxpayers must ensure their federal income tax returns are filed by april 15, 2024. Web tax day 2024 is on monday, april 15, deadline for americans to file their income taxes with the internal revenue service.. Taxpayers filing early can expect their refunds to be processed from this date onwards. Web if the employer deferred paying the employer share of social security tax or the railroad retirement tax equivalent in 2020, 50% of the deferred amount of the employer share of social security tax was due by january 3, 2022, and. Web the irs is scheduled. Returns should be filed by the due date of each return. Web nov 9, 2023,02:22pm est share to facebook share to twitter share to linkedin 2024 numbers getty the irs has announced the annual inflation adjustments for the year 2024, including tax rate. Web the internal revenue service will soon release a comprehensive set of 1040 tax forms, schedules, and. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. People who live in areas that were affected by natural disasters may also have later deadlines. This crucial date applies to most taxpayers, including those with tax liabilities for. Web calendar year filers (most common) file on: Web due dates for 2023 estimated tax payments. 3q — september 16, 2024; Web the internal revenue service will soon release a comprehensive set of 1040 tax forms, schedules, and instructions for the tax year 2024. Web taxpayers have until tuesday, april 18, 2023, to file their 2022 tax return since april 15, 2023 falls on a federal holiday. April 1 to may 31. Web 2023 payroll year end due dates. Web payments for estimated taxes are due on four different quarterly dates throughout the year. Then direct deposit refund may be sent as. June 1 to august 31, 2023. Taxpayers filing early can expect their refunds to be processed from this date onwards. For the 2023 tax year, the primary deadline for filing federal income tax returns is april 15, 2024. When income earned in 2023.

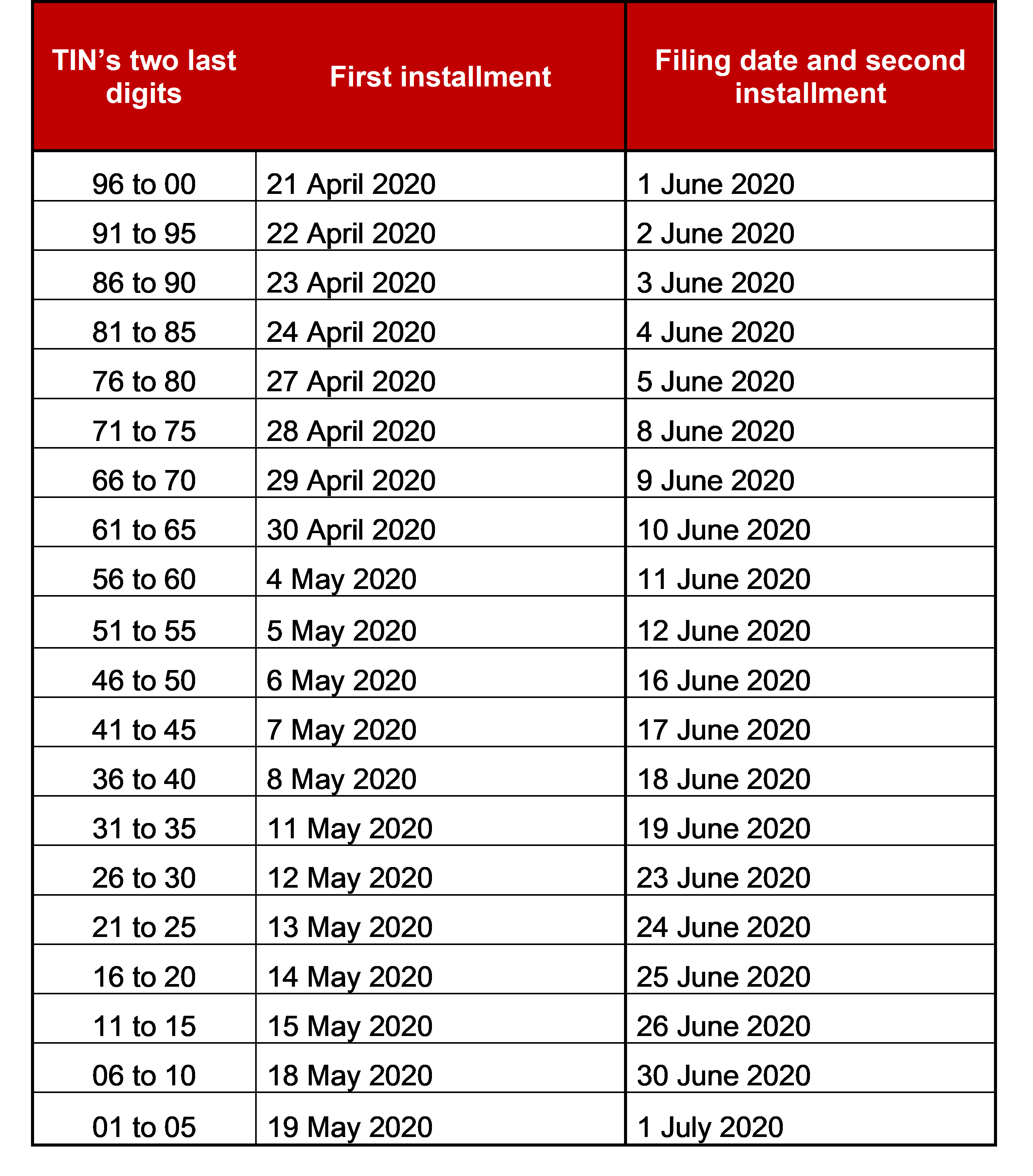

Corporate Tax filing and paying due dates postponed Brigard

fiscal calendars 2024 free printable word templates fiscal calendars

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Federal Tax Deadlines in 2022

Tax Due Date Marked in Red on Calendar with Pencil Stock Image Image

Tax Calendar & Due Dates Bal & Associates, CPA Inc.

Keep Your Federal Tax Planning Strategy On Track With Key Irs Filing Dates.

The Fourth Month After Your Fiscal Year Ends, Day 15.

2Q — June 17, 2024;

Web The Irs Has Set The Following Deadlines For The Upcoming Tax Season:

Related Post: